<soapenv:Body>

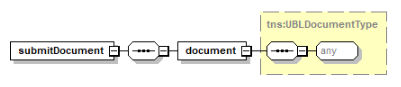

<v1:submitDocument>

<v1:document>

<Invoice xmlns="urn:oasis:names:specification:ubl:schema:xsd:Invoice-2" xmlns:cbc="urn:oasis:names:specification:ubl:schema:xsd:CommonBasicComponents-2" xmlns:cac="urn:oasis:names:specification:ubl:schema:xsd:CommonAggregateComponents-2">

<cbc:UBLVersionID>2.1</cbc:UBLVersionID>

<cbc:CustomizationID>urn:www.cenbii.eu:transaction:biitrns010:ver2.0:extended:urn:www.peppol.eu:bis:peppol5a:ver2.0</cbc:CustomizationID>

<cbc:ProfileID>urn:www.cenbii.eu:profile:bii05:ver2.0</cbc:ProfileID>

<cbc:ID>Peter20479086FAKSEP-4-5A</cbc:ID>

<cbc:IssueDate>2018-06-12</cbc:IssueDate>

<cbc:InvoiceTypeCode listID="UNCL1001">380</cbc:InvoiceTypeCode>

<cbc:DocumentCurrencyCode listID="ISO4217">EUR</cbc:DocumentCurrencyCode>

<cac:AccountingSupplierParty>

<cac:Party>

<cac:PartyIdentification>

<cbc:ID schemeID="BE:CBE">2222111111</cbc:ID>

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>ACME</cbc:Name>

</cac:PartyName>

<cac:PostalAddress>

<cbc:StreetName>Simon Bolivarlaan 30/9</cbc:StreetName>

<cbc:CityName>BRUSSEL</cbc:CityName>

<cbc:PostalZone>1000</cbc:PostalZone>

<cac:Country>

<cbc:IdentificationCode listID="ISO3166-1:Alpha2">BE</cbc:IdentificationCode>

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID schemeID="BE:VAT">BE2222111111</cbc:CompanyID>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyLegalEntity>

<cbc:RegistrationName>D.W. Soft bvba</cbc:RegistrationName>

<cbc:CompanyID schemeID="BE:CBE">2222111111</cbc:CompanyID>

</cac:PartyLegalEntity>

<cac:Contact>

<cbc:ElectronicMail>someone@domain.be</cbc:ElectronicMail>

</cac:Contact>

</cac:Party>

</cac:AccountingSupplierParty>

<cac:AccountingCustomerParty>

<cac:Party>

<cac:PartyIdentification>

<cbc:ID schemeID="BE:CBE">2222222222</cbc:ID>

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>Fake customer</cbc:Name>

</cac:PartyName>

<cac:PostalAddress>

<cbc:StreetName>Simon Bolivarlaan 34</cbc:StreetName>

<cbc:CityName>ANTWERPEN</cbc:CityName>

<cbc:PostalZone>2000</cbc:PostalZone>

<cac:Country>

<cbc:IdentificationCode listID="ISO3166-1:Alpha2">BE</cbc:IdentificationCode>

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID schemeID="BE:VAT">BE2222222222</cbc:CompanyID>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyLegalEntity>

<cbc:RegistrationName>Fake Customer</cbc:RegistrationName>

<cbc:CompanyID schemeID="BE:CBE">2222222222</cbc:CompanyID>

</cac:PartyLegalEntity>

</cac:Party>

</cac:AccountingCustomerParty>

<cac:PaymentMeans>

<cbc:PaymentMeansCode listID="UNCL4461">1</cbc:PaymentMeansCode>

<cbc:PaymentDueDate>2018-05-31</cbc:PaymentDueDate>

<cbc:PaymentChannelCode>IBAN</cbc:PaymentChannelCode>

<cbc:InstructionNote>SIMPLE TEST TO FAKE CUSTOMER</cbc:InstructionNote>

<cac:PayeeFinancialAccount>

<cbc:ID schemeID="IBAN">BE88833300055550</cbc:ID>

<cac:FinancialInstitutionBranch>

<cac:FinancialInstitution>

<cbc:ID schemeID="BIC">KREDBEBB</cbc:ID>

</cac:FinancialInstitution>

</cac:FinancialInstitutionBranch>

</cac:PayeeFinancialAccount>

</cac:PaymentMeans>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="EUR">21.00</cbc:TaxAmount>

<cac:TaxSubtotal>

<cbc:TaxableAmount currencyID="EUR">100.00</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="EUR">21.00</cbc:TaxAmount>

<cac:TaxCategory>

<cbc:ID schemeID="UNCL5305">S</cbc:ID>

<cbc:Percent>21.00</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

</cac:TaxTotal>

<cac:LegalMonetaryTotal>

<cbc:LineExtensionAmount currencyID="EUR">100.00</cbc:LineExtensionAmount>

<cbc:TaxExclusiveAmount currencyID="EUR">100.00</cbc:TaxExclusiveAmount>

<cbc:TaxInclusiveAmount currencyID="EUR">121.00</cbc:TaxInclusiveAmount>

<cbc:PayableAmount currencyID="EUR">121.00</cbc:PayableAmount>

</cac:LegalMonetaryTotal>

<cac:InvoiceLine>

<cbc:ID>1</cbc:ID>

<cbc:InvoicedQuantity unitCode="NAR" unitCodeListID="UNECERec20">1.00</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="EUR">100.00</cbc:LineExtensionAmount>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="EUR">21.00</cbc:TaxAmount>

</cac:TaxTotal>

<cac:Item>

<cbc:Description>Line1 description - may be long</cbc:Description>

<cbc:Name>Line1max50char</cbc:Name>

<cac:ClassifiedTaxCategory>

<cbc:ID schemeID="UNCL5305">S</cbc:ID>

<cbc:Percent>21.00</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

</cac:Item>

<cac:Price>

<cbc:PriceAmount currencyID="EUR">100.00</cbc:PriceAmount>

<cbc:BaseQuantity>1.00</cbc:BaseQuantity>

</cac:Price>

</cac:InvoiceLine>

</Invoice>

</v1:document>

</v1:submitDocument>

</soapenv:Body> |